Fed’s imminent rate cut to facilitate Vietnam central bank’s monetary loosening

The U.S. Federal Reserve's (Fed) likely interest cut next month will help the State Bank of Vietnam loosen its monetary policy after a period of resorting to several tools to curb the dong’s devaluation.

Minutes of the Fed's July 30-31 meeting released Wednesday indicated that the Fed will likely cut interest rates at its September meeting if economic data continues to come in as expected.

The Chicago Mercantile Exchange Group's FedWatch Tool, which acts as a barometer for the market's expectation of the Fed funds target rate, showed that the probability of the Fed cutting rates by 25 basis points at the September meeting is 62% as of Wednesday night.

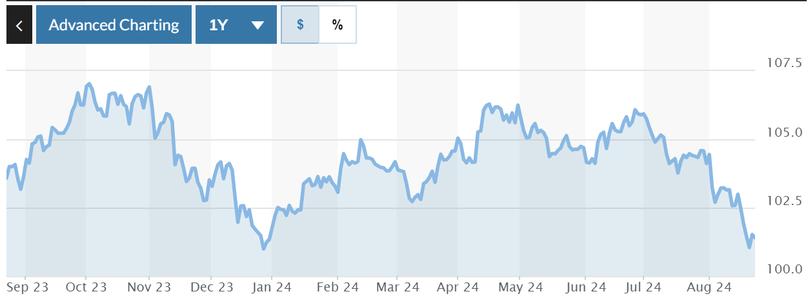

The U.S. Dollar Index (DXY), which measures the greenback’s strength, was trading at 101.45 at the time of writing, losing 3.18% over the past three months to a low in nearly eight months.

The U.S. Dollar Index (DXY). Chart by MarketWatch.

Meanwhile, in Vietnam, USD supplies have become more abundant thanks to rising foreign direct investment disbursement and a robust trade surplus. These factors have helped the USD/VND exchange rate cool on both official and free markets.

On the interbank market, the USD/VND rate has dropped to below VND25,000 a dollar. The rate has decreased 1.3% on this market this month.

At commercial banks, the forex rate has eased VND300-350 from end-July, or 1.3%. Vietcombank, the largest forex trader in the country, quoted the greenback at VND24,780-25,150 a dollar for bids and asks on Friday, respectively, far below a peak of VND25,480 late in May.

Against end-2023, USD prices at commercial banks have slid 2.8%, narrowing considerably from a 5% increase between January and May.

On the unofficial market, the dollar is being offered at VND25,350-25,430, down 2.3% from a peak of VND26,000 in June.

Analysts with ACB Securities said recently that the USD/VND rate fell to below VND25,000 thanks to the weakening of the USD globally and rising USD supplies in Vietnam.

They forecast the forex rate to continue its slide to the VND24,800 territory before the Fed's policymakers meet again on September 18.

After the Lunar New Year festival in mid-February, in the face of a stronger dollar due to the Fed’s delay in cutting rates, the State Bank of Vietnam (SBV) had to resume issuing Treasury bills in mid-March to drain excess liquidity on the interbank market.

In addition, the SBV raised the coupon rate of T-bills and the open market operation (OMO) rate to 4.5% late in June.

Those moves were meant to narrow the interest gap between USD- and VND-denominated borrowings.

The SBV's headquarters in Hanoi. Photo courtesy by Nguoi Dua Tin (New Courier) magazine.

To further protect the dong, the SBV started to sell hard currency in April. Sources estimated that the SBV sold some $6 billion to commercial banks in two months.

On the back of a weaker greenback, the SBV lowered the OMO and T-bill interest rates by 25 basis points to 4.25% per annum on August 5. The T-bill rate fell further to 4.2% on August 20.

According to analysts, that the SBV reduced the OMO and T-bill rates was aimed to support the system’s liquidity and lower interest rate levels in the interbank market.

Lower interest rates are expected to boost credit growth in the rest of the year. Lending had expanded 6% as of end-June from end-2023, accelerating from 3.4% a month earlier, SBV data showed.

Link nội dung: https://myphamsakura.edu.vn/tinnew-net-tinnew-a53787.html